The Ottawa Transit Commission convened on Thursday, April 11, for its monthly meeting. OC Transpo head Renee Amilcar and OC Transpo staff began the presentation…

The Irish Famine of 1846-1852 was one of the darkest events in Ireland’s history, effectively reducing the population of eight million by half. However, a…

Canada is in the grip of a housing crisis, and the federal government, along with the Canada Mortgage and Housing Corporation (CMHC), is under scrutiny…

The Economic Development Strategy and Action Plan was the first issue of contention at today’s meeting of Ottawa City Council. The document, which is significant…

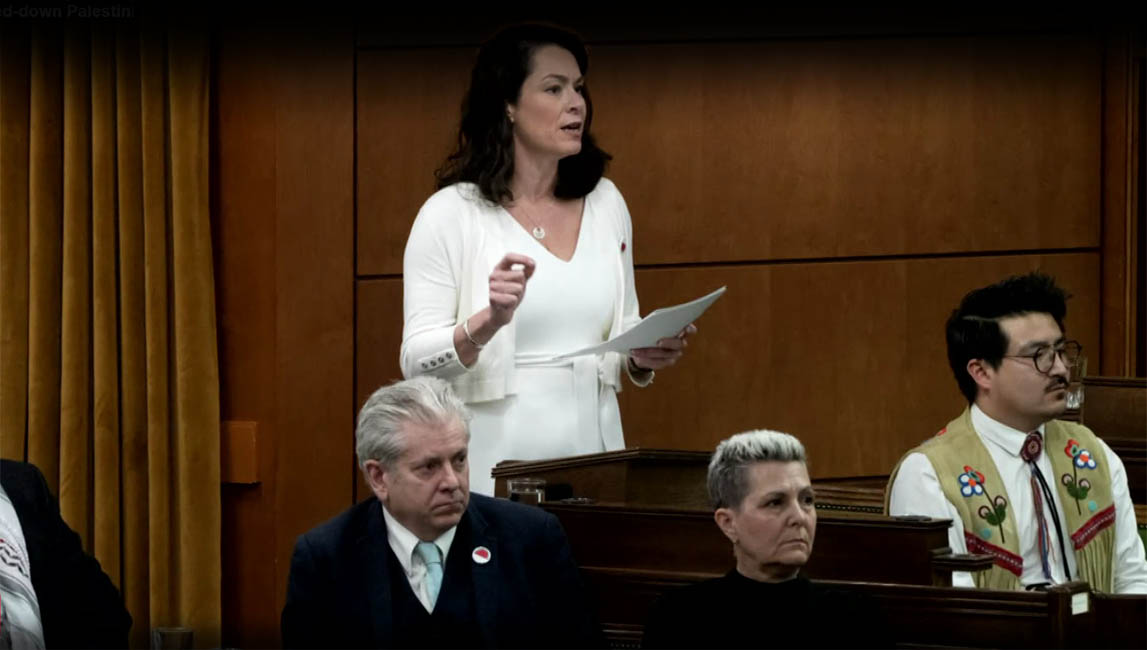

Antisemitism on full display in Parliament courtesy of Jagmeet Singh and the NDP-Liberal Coalition. “Those who cannot remember the past are condemned to repeat it.”…