Accident Claim vs Own Damage Claim: What’s the Difference?

A scratch in a crowded market lane and a major crash on a highway are very different incidents, but they create the same immediate worry: Will my policy cover this? In India, the confusion usually starts with the phrase accident claim. People use it for any mishap, while insurers categorise claims based on who suffered the loss. Get this part right, and everything becomes simpler: what you report, what proof you keep, and what you can expect at settlement.

In this article, you’ll explore when to file each claim, what it covers, and how to avoid common mistakes.

Understanding Accident Claims in Car Insurance

In car insurance, an accident claim often points to a third-party liability claim. This is raised when an accident involving your car causes injury, death, or property damage to someone else. The focus is not on fixing your car. It is about the legal liability you may have towards the affected third party.

What This Claim Is Really About

Third-party liability is usually triggered when:

• Another road user is hurt.

• Someone else’s vehicle or property is damaged.

• A complaint is filed, and responsibility needs to be established.

What It Typically Covers

Based on the policy wording and the incident details, it may cover:

• Liability linked to third-party injury or death

• Compensation for third-party property damage, where applicable

• Legal support for handling the claim through formal channels

How It Is Usually Processed

Because a third party is involved, official records often matter.

• File a police report if needed, then share FIR details with the insurer.

• Exchange names, numbers, vehicle details, and click clear photos at the scene.

• Inform your insurer quickly and follow their guidance on forms and documents.

Understanding Own Damage Claims and Where Comprehensive Insurance Fits

An own damage claim is for loss to your own car. You use it when your vehicle is damaged, and you want the insurer to pay for repairs or compensate you in accordance with the policy terms. You can typically claim this if you have comprehensive insurance or a standalone own-damage cover purchased alongside third-party liability.

What You Can Claim under Own Damage

Own damage cover is meant for sudden, unforeseen damage to your car, such as:

• Collision-related repairs and parts replacement

• Damage from skidding, overturning, or impact with objects

• Fire-related damage and certain external impacts

• Theft or attempted theft, including related damage

• Select natural events, such as flooding, that are covered in your policy.

Common Reasons Claims Get Delayed Or Rejected

Many claim issues come down to avoidable gaps, for example:

• Informing the insurer late, especially if the damage worsens in the meantime

• Starting repairs before the insurer’s inspection or approval

• Missing documents or unclear incident details

• Exclusions such as driving without a valid licence or driving under the influence

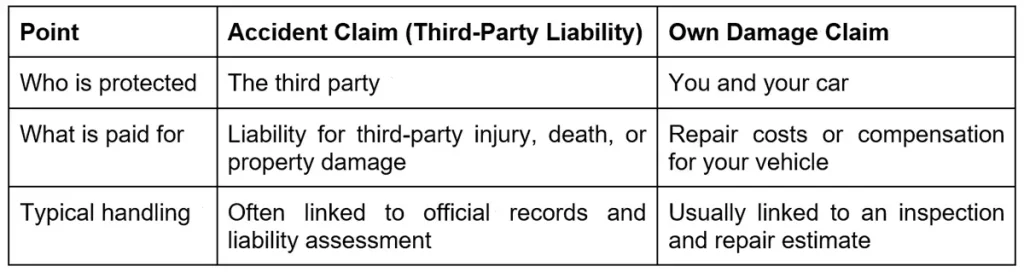

Key Differences at a Glance

Here’s a quick, no-confusion comparison so you can choose the right claim type immediately after an accident or damage incident.

Which Claim Should You File after a Crash?

Here is a quick way to decide, using a common scenario. If your car hits another vehicle and both cars are damaged, you may need to report third-party liability for the other person’s loss and also raise an own damage claim for your repairs.

As a rule of thumb:

• If anyone outside your car is injured or their property is damaged, report it as third-party liability and follow the insurer’s guidance on documentation.

• If your car needs repairs and you have own damage cover, raise an own damage claim and ask about cashless repairs at a network garage.

• If both apply, disclose both upfront. It is easier than explaining gaps later.

A small habit that saves time: take clear photos of the scene and visible damage when it is safe, note the other vehicle’s registration number, and keep basics like your driving licence and RC handy.

Final Takeaway

Accidents are unpredictable, but your claim route does not have to be. Third-party accident claims deal with liability towards others, while own damage claims deal with restoring your car under your cover. When you know the difference, you can report confidently, share cleaner documentation, and reduce avoidable delays.