A Misguided Banker

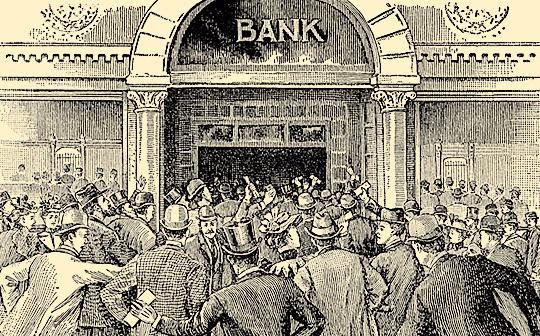

I read with interest a Bloomberg article entitled “Italy Could Spark European Bank Crisis.”

The article quotes Societe Generale Chairman Lorenzo Bini Smaghi as saying that “governments must accept the idea of taxpayer money as the ultimate recourse.” Lorenzo Bini Smaghi has held many impressive positions within the European Union and has always been a voice for conservative monied interest. In this instance, he has overstepped his knowledge base, economics and political training.

Taxpayer intervention in the European moribund banking sector will simply kick the can down the road, induce massive political protest and continue the transfer of wealth from the middle classes to the upper classes. It would (will) be a great mistake to take the Bini Smaghi route.

Taxpayer’s money should be reserved for the protection of depositors, not the preservation of jobs for poor and crony bank managements. Approximately 80 per cent of the European Banking community is technically insolvent. (See “China? Oil Prices? Why Volatility. The Grand Surprise Part Two” European section, dated January 12, 2016.)

The solution to the European Banking Crisis is straightforward:

- Stress Tests which test for bank viability should the appropriate write downs be instituted.

- The winding down or closure of all banks which do not pass the test. (Shareholders, debt holders, junior and senior take the hit, not taxpayers.) Depositors are protected, and only depositors, by taxpayer intervention.

- A reconstituting of those banks strong enough to survive the stress tests with managements qualified and incentivized to carefully run institutions that gather funds as deposits and loans those funds out responsibly to both businesses and consumers.

This house cleaning will restart a now moribund European Banking System. Nothing less will do more than delay the ultimate demise of most banks and the EU, itself.