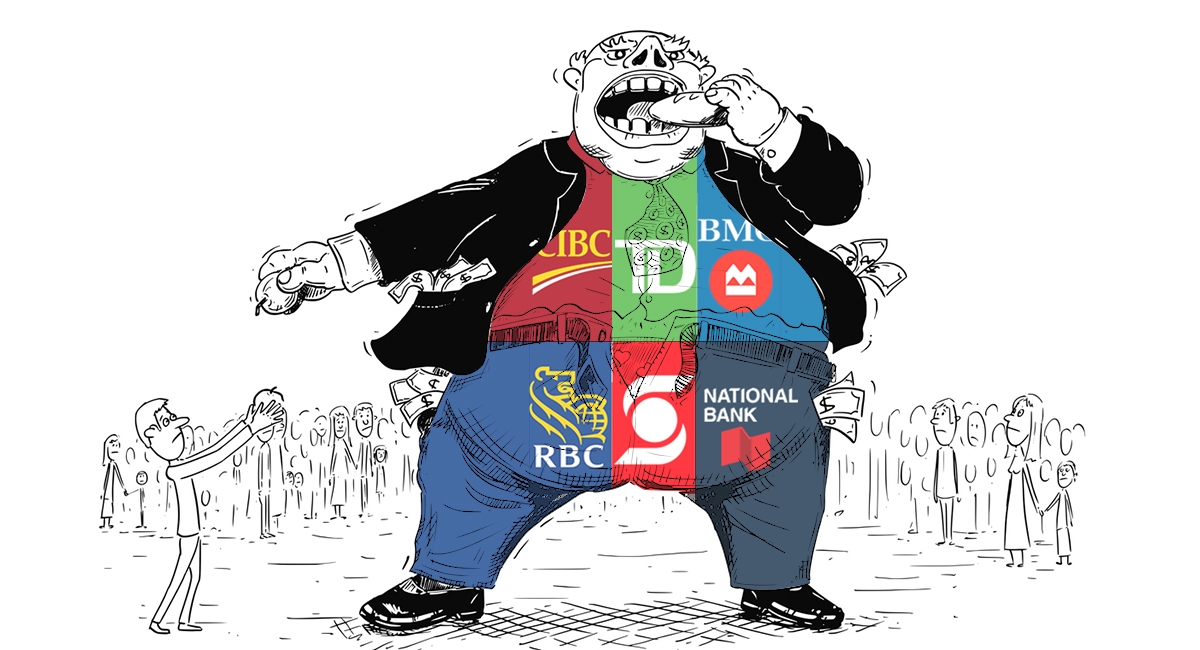

Canada’s gluttonous banks and their greedy CEOs reel in record profits during pandemic

Canada’s Big 6 Banks reported a 14 per cent increase in their 2021 first-quarter profits, and extremely high profits in 2020 totalling $41.13 billion, just $5.1 billion (12 per cent) less than in 2019 (BMO – $5.1B; CIBC – $3.8B; National – $2.08; RBC – $11.4B; Scotiabank – $6.85B; TD – $11.9B). The Big 6 had record profits of more than $46 billion in 2019 – for the 10th year in a row, and more than double their 2010 profits. Four of Canada’s Big 6 Banks are listed in Fortune’s Global 500 for 2020, and are the 15th (RBC), 20th (TD), 32nd (Scotiabank) and 50th (BMO) most profitable financial institutions in the world, and the four most profitable Canadian companies in the Global 500.

Canada’s banks are an oligopoly. An oligopoly is a privileged and protected system where there is no real competition and the industry—in this case banking—is dominated by a small group of large sellers. Oligopolies can result from various forms of collusion that reduce market competition which then leads to higher prices for consumers and lower wages for the employees of oligopolies. Canadian banks have some of the highest customers service charges in the western world and pay their employees a pittance compared to the hoggish salaries paid to bank executives who are essentially administrators of the money that it thrown their way due to the lack of competition. In Canada, the banks collusion and control of the market is so secure and ridiculous that the government even permits them to charge customers to make deposits.

Worse than the shameless profiteering of the banks is the greed pig behaviour of the individual CEOs of each of Canada’s Big 6 Banks who raked in a total of $75 million in 2019 in salary and bonuses (an average of $12.5 million each), and a total of $66.4 million in 2020 ($11 million each on average). This, while hundreds of thousands of Canadian businesses have gone out business or bankrupt during the Covid-19 pandemic. Canadian banks have not reduced service fees or taken any extraordinary measure to help businesses or individual clients because they do not have to, due to the oligopoly. Canadian Bank CEOs would make no where near those salaries if they were forced to compete in a real market or if they paid their employees more or reduced service charges which amount to billions of dollars each year to customers.

In response to the outrageous and egregious behaviour of the banks, Democracy Watch, along with the more than 100,000 people from across Canada have initiated a letter-writing campaign and petition calling for Prime Minister Trudeau and Finance Minister Chrystia Freeland to make Canada’s big banks do more to help Canadians and small businesses, and pay their fair share of taxes, now and after the coronavirus crisis.

Exactly one year ago, on April 6, 2020, after the Big 6 Banks announced temporary mortgage and loan payment deferrals, and credit card interest rate cuts, for only some customers, Prime Minister Trudeau said that “we need to see even more action like this going forward because this is a time to think about each other, not about the bottom line.” However, the deferrals and cuts for some bank customers ended last fall, and the banks have not given any breaks since.

Democracy Watch recently filed a submission with Finance Canada’s pre-budget consultation process calling for eight key changes (set out further below) needed to make Canada’s banks help more, stop racism and discrimination in lending and services, and stop gouging and other abuses.

Many of the eight key changes were enacted in the U.S. decades ago and apply to the U.S. banks that four of Canada’s Big 6 Banks own. In contrast, the Trudeau Liberals have nothing substantive to address discrimination in bank lending, and nothing to stop gouging of all customers. Recently, associations representing Black and Indigenous business owners called for the U.S. measures to be enacted in Canada to stop discrimination in bank lending.

“The big banks can afford to do much more to help during this crisis and must be required by law to disclose much more information about how they treat customers and borrowers, and about their profits in every part of their business, to ensure they don’t gouge, discriminate against or abuse anyone and to ensure they are effectively required to serve everyone fairly and well with fair interest rates and fees,” said Duff Conacher, co-founder of Democracy Watch.

“The federal government cannot tell if the banks are still gouging or treating customers unfairly in this crisis, and won’t be able to tell post-crisis, because the banks are allowed to keep secret the profit levels in each area of their business, what type of borrowers they approve and reject for loan and credit relief, and how many complaints they are receiving,” said Conacher. “As the U.S. did more than 40 years ago, the federal government must require the banks to disclose this information and more to ensure the banks don’t discriminate against anyone and give everyone who needs it a real break in their loan and credit card payments during the crisis and serve everyone fairly and well at fair interest rates and fees that give the banks a reasonable profit and not excessive gouging profit levels.”

Former Finance Minister Bill Morneau boasted in early April 2020 that the federal government negotiated with the Big 6 Banks to temporarily cut some credit card interest rates for some customers (but not for small businesses) who request a deferral for a couple of months, and to process small business loans funded by the government, in addition to the up-to-6-month mortgage and loan deferrals and fee reductions the banks have already offered (but again, only for some customers, with the delayed amount still required to be paid later, plus interest).

However, those payment deferrals of about $1 billion ran out for most people last fall, including about 760,000 Canadians who deferred their mortgage.

Worse, as The Big 6 Banks continue to reap high profits by firing thousands of people, shifting jobs overseas (or using temporary foreign workers), cutting services, and hiking fees and credit card interest rates even as the Bank of Canada’s prime rate has dropped to record low levels.

The more than 100,000 people who have signed the letter or petition, along with Democracy Watch are calling on federal parties to work together now to require the banks:

- To cut all their interest rates and fees in half now and cut loan payments entirely for anyone who needs it, without requiring payment or extra interest later.

- To disclose detailed profit reports after fully independent audits and keep rates and fees at reasonably low levels in the future (for example, many U.S. states cap credit card interest rates).

- To empower consumers and increase consumer protection by supporting the creation of an independent, consumer-run bank watchdog group (as recommended by MPs and senators in 1998).

- To disclose approval rates for credit, loans and account services by neighbourhood and type of borrower, and require corrective actions by any bank that discriminates (as the S. has required for more than 40 years under the Community Reinvestment Act) as part of their annual Public Accountability Statements.

- To re-open basic banking branches in neighbourhoods (where they closed them in the 1990s) to help get rid of predatory pay-day loan companies (and banking at Canada Post outlets should also be allowed to help ensure everyone has access to basic banking services at fair rates and fees).

- To cut bank executive pay down to a reasonable level (as in some European countries).

- To pay their fair share of taxes now, and in the future, by closing all the loopholes they exploit and (as England and Australia have) by imposing an excess profits tax, and.

- Democracy Watch says that enforcement measures and penalties also need to be strengthened to ensure banks, and other financial institutions, serve everyone fairly and well at fair prices.

Illustration: Zdenek Sasek, iStock