Carney’s Canada-China Pivot: Trade, Tensions, and the Hong Kong Bridge

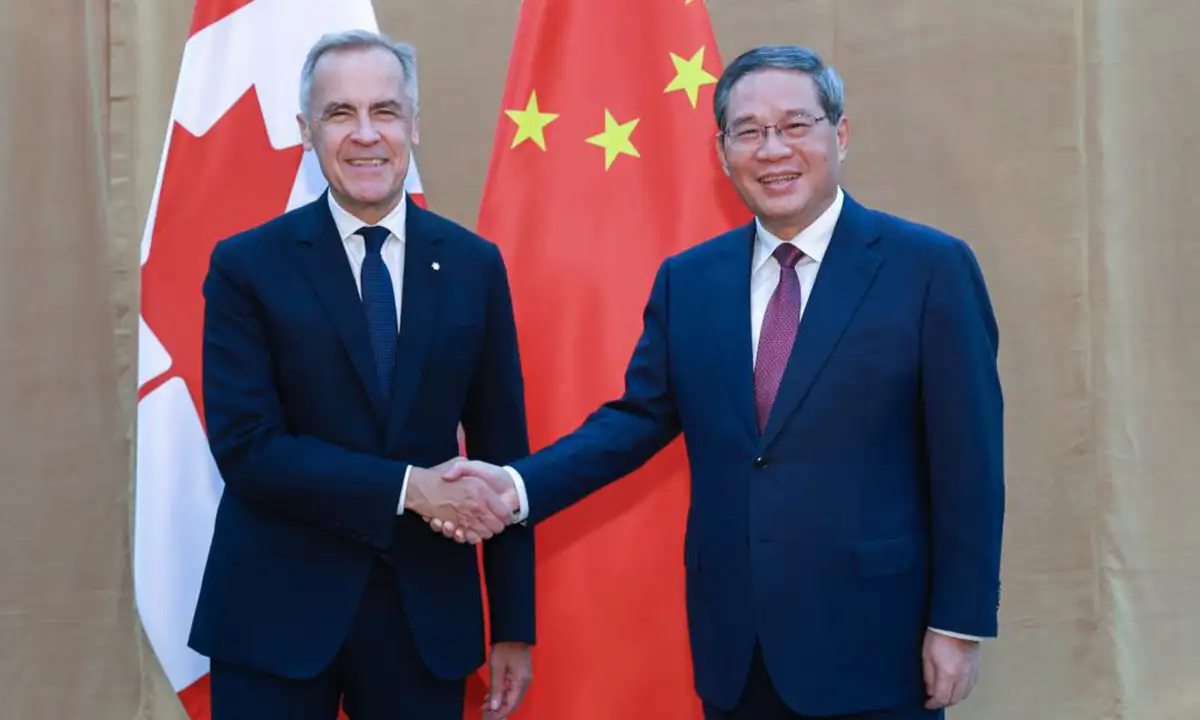

Prime Minister Mark Carney’s meeting this week with Chinese Premier Li Qiang in New York marks a significant turning point in Canada-China relations. Held on the sidelines of the United Nations General Assembly, the dialogue was described by Carney as “very constructive,” building on earlier ministerial exchanges and setting the stage for a future meeting with President Xi Jinping.

“Those discussions will deepen,” Carney told reporters. “I will expect, at the appropriate time, to be meeting with President Xi Jinping but continuing this dialogue with the premier.”

The conversation touched on key sectors including clean and conventional energy, agriculture, and steel. Carney confirmed that Foreign Affairs Minister Anita Anand will soon visit China to continue the diplomatic momentum — a move that signals Ottawa’s intent to recalibrate its trade strategy amid shifting global dynamics.

A Complex Relationship with Room to Grow

China is Canada’s second-largest trading partner, after the United States. In 2024, Canada exported approximately $30 billion in goods to China, while importing over $87 billion, resulting in a trade deficit of $57 billion. By comparison, Canada exported $500 billion to the United States, underscoring the scale of opportunity for diversification.

Relations between Canada and China have been strained in recent years, particularly following Ottawa’s decision to impose 100 percent tariffs on Chinese-made electric vehicles, largely in response to U.S. trade pressure. Beijing retaliated with steep levies on Canadian canola meal, seed, pork, and seafood — a blow that landed hardest in Western Canada. The impact of these retaliatory tariffs on the canola sector has been severe, especially in Saskatchewan and other Prairie provinces.

In August 2025, China imposed a 75.8 percent provisional duty on Canadian canola seed, followed by 100 percent tariffs on canola oil and meal. These measures targeted a sector that contributes more than $43.7 billion annually to Canada’s economy — exceeding the combined value of the country’s steel, aluminum, and auto manufacturing industries. Saskatchewan, which produces more than half of Canada’s canola, planted 12.1 million acres and harvested 9.7 million tonnes in 2024. The province’s canola industry supports over 55,000 direct jobs, making it a cornerstone of Western Canada’s economic engine.

Premier Scott Moe has been outspoken about the urgency of resolving the dispute, stating: “Our canola sector is being unfairly targeted. Ottawa must resolve this quickly — we can’t afford to lose access to one of our largest markets.”

He also emphasized that the tariffs wiped out more than $610 million in value for Western farmers in a single day, warning that a full ban could cost Saskatchewan 3,800 direct jobs. Moe’s comparison of the canola sector to Ontario’s auto industry is not rhetorical — it’s backed by hard data. While Ontario’s auto exports were valued at $32 billion in 2024, Canada’s canola exports to China alone reached $4.9 billion, with seed accounting for $4 billion. The Saskatchewan Chamber of Commerce echoed these concerns in a letter to Prime Minister Carney, urging the federal government to treat Western agriculture with the same urgency as other industries facing trade disputes.

Resolving the canola crisis is more than a matter of trade — it’s a political litmus test-A Test of the West– for Carney’s government. Failure to restore market access and protect the livelihoods of tens of thousands of Western Canadians risks deepening regional divides and undermining Ottawa’s credibility in rural Canada. As Moe put it:

“This is a sensitive and delicate dance . . . but there are signals being sent.”

Whether Carney can turn those signals into solutions will determine if his diversification strategy is truly national — or just another Ottawa-centric plan that leaves the West out.

One option being quietly considered is whether Canada should ease or remove its EV tariffs to restore agricultural trade. However, doing so could complicate Canada’s commitments under the Canada–United States–Mexico Agreement (CUSMA), which governs auto manufacturing rules across North America. Loosening restrictions on Chinese EVs could disrupt regional supply chains — but may be necessary if Canada is serious about diversifying its trade portfolio.

Trump Tariffs and Canada’s Strategic Pivot

The renewed engagement with China comes in the wake of continuing trade tensions with the United States. Since returning to office in January, President Donald Trump has reimposed tariffs on Canadian steel, aluminum, and agricultural products, prompting Ottawa to reassess its trade dependencies and look for new global customers.

On September 5, 2025, Prime Minister Carney unveiled a sweeping “Buy Canadian” strategy in Mississauga, Ontario, aimed at strengthening domestic industries and diversifying trade.

“We are charting an economic strategy to move Canada from reliance to resilience, from uncertainty to prosperity,” Carney said. “We know we need to act now. Invest now. Precisely when it’s hard.”

This strategic pivot includes expanding trade ties with China, whose economic priorities — including electric vehicles, agriculture, energy, green energy and infrastructure — align with Canada’s strengths. The Belt and Road Initiative (BRI), China’s flagship global development strategy, has become a cornerstone of its international engagement.

Hong Kong: A Gateway to Belt and Road Opportunity

The timing of this renewed engagement is significant, coming just weeks after the 10th Annual Belt and Road Summit in Hong Kong — a global forum earlier this month that showcased the BRI’s achievements over the past decade. Since its launch in 2013, the BRI has mobilized over US$1 trillion in infrastructure investment across 150+ countries, completing more than 3,000 projects ranging from ports and railways to energy grids and digital corridors.

While the BRI has traditionally focused on the Global South — with major developments in Africa, Southeast Asia, and Latin America — Hong Kong has emerged as a strategic financial and logistics hub for the initiative. As Dr. Patrick Lau, Deputy Executive Director of the Hong Kong Trade Development Council, stated at the summit: “We remain dedicated to deepening this international cooperation platform and turning the Initiative’s vision into tangible partnerships and achievements.”

Nicholas Ho, Commissioner for the Belt and Road Initiative, reinforced this view, noting: “Now more important than ever, Hong Kong has a very pivotal role, as a hub to aggregate global capital, global projects and to redeploy them and to make them bankable.” His remarks underscore Hong Kong’s function not just as a gateway to China, but as a global launchpad for infrastructure investment — a role that aligns closely with Canada’s strengths in engineering, energy, and finance.

Hong Kong’s role is especially relevant for Canada. The city is home to over 300 Canadian companies, and more than 200,000 Canadians live or work in Hong Kong — the largest Canadian expatriate community in Asia. Bilateral trade between Canada and Hong Kong exceeded $4.5 billion in 2024, with strong ties in finance, education, and professional services.

Loretta Leet, Director-General of InvestHK, emphasized Hong Kong’s unique position: “Hong Kong is where East meets West — we offer Canadian companies a launchpad into Asia, and we’re seeing growing interest in Belt and Road-linked partnerships that bring Canadian expertise into global infrastructure and innovation projects.”

One of the most reputable firms operating in this space is TempleWater Hong Kong Limited, a leading alternative asset manager specializing in private equity, energy transition, and real estate investments. Founded as a spin-off from Investec’s principal investment business, TempleWater is known for its hands-on operational approach and mid-market buyout strategies across Asia. Its CEO, Cliff Zhang, has deep ties to Vancouver and Canada’s West Coast business community.

Zhang expressed interest in expanding TempleWater’s footprint in Canada, noting that many Hong Kong-based firms are actively exploring partnerships and investment opportunities. However, he acknowledged that regulatory hurdles have made it challenging.

“There’s a lot of interest from Hong Kong firms in investing in Canada,” Zhang said. “But the process and regulatory environment have made it difficult to execute. If that were to change, I see tremendous potential for enterprise growth and cross-border collaboration.”

In the meantime, TempleWater remains focused on BRI-linked projects in the Global South, but Zhang added: “Canada has the talent, stability, and market sophistication to be a great place for business — if the opportunities are made accessible.”

Energy, Hydrogen, and Infrastructure: Canada’s Competitive Edge

Beyond trade, there is immense potential for Canadian energy exports to China — from LNG and conventional oil to renewables and hydrogen. Chinese firms have shown growing interest in partnering with Canadian companies to build major infrastructure projects, including pipelines, extraction facilities, and clean energy corridors.

At the Belt and Road Summit, hydrogen was a standout theme. Investors from Hong Kong and mainland China expressed strong interest in green hydrogen, and Canada is well-positioned to lead. With world-class research institutions, abundant natural resources, and companies like Ballard Power Systems and Hydrogenics at the forefront, Canada could become a key supplier in Asia’s clean energy transition.

Political Headwinds and the Credibility Gap

Despite the economic logic behind diversification, Carney faces political resistance at home. While the Official Opposition agrees that Canada must reduce its dependence on the United States, Conservative leaders have been vocally critical of deeper engagement with China.

During a campaign event in August 2025, Conservative leader Pierre Poilievre, then running in a federal by-election, accused the Liberal government of “cozying up to a regime that undermines Canadian values and security.” Conservative MP Michael Chong echoed this sentiment in a separate statement, saying: “We must not trade away our principles for short-term economic gain.”

But Carney’s biggest challenge may be a growing credibility gap. While he travels abroad promoting Canada as a destination for investment, his government has yet to repeal or reform key legislation — most notably Bill C-69, also known as the Impact Assessment Act — which many business leaders say is stifling investment.

Alberta Premier Danielle Smith has repeatedly called for the law to be “repealed or substantially revised,” arguing that it imposes ideological and unclear requirements on energy projects.

“There are measures in the bill that are not technical, that are ideological and that don’t really have any measurables around them and create confusion,” Smith said in June.

Goldy Hyder, President of the Business Council of Canada, has also warned that Canada’s reputation is suffering: “We need to stop sending mixed signals. If we want investment, we need to be competitive — that means predictable rules, lower taxes, and a business environment that doesn’t scare people off.”

Without addressing these domestic barriers, Carney risks becoming — as some critics have put it — a leader who “sells the sizzle but forgets the steak.” His international pitch may be compelling, but unless Canada is seen as a place where projects can be built and businesses can thrive, the investment won’t follow.

“Canada has what the world wants,” Carney said in his address to the Council on Foreign Relations earlier this week. “We are a reliable partner with connections to every major market in the world.”

With diplomatic channels reopening and economic incentives aligning, the Carney-Li meeting — coupled with Hong Kong’s Belt and Road momentum — may mark the beginning of a new chapter in Canada-China relations. But unless Ottawa clears the path at home, the bridge to global opportunity may remain under construction.

Photo: Courtesy Xinhua/Wang Ye, The Global Times