Virus forces new role on the Bank of Canada

— with great responsibility comes greater accountability

By Greg MacDougall and Dan McCarthy

While pop culture ascribes articulating the linkage between great power and responsibility to Peter Parker’s Uncle Ben, the quote “They must consider that great responsibility follows inseparably from great power” actually originates in the French Revolution. The third pillar of democratic reform – accountability – was left unstated. But then, no one can say that the revolutionaries did not exact a terrible accountability from the monarchical class.

The historical comparison with Covid-era Canada is obviously inexact, but there is no denying that in addition to responsibility flowing from the great power exercised by the Government of Canada and institutions such as the Bank of Canada, greater accountability is required for decisions taken during the pandemic. The traditional concept of ministerial responsibility has frayed over the years, and in this year of Covid, has been further diminished by both a lack of personal responsibility on the part of several ministers and the shrunken institution we call Parliament. But ministers remain accountable to Parliament through Question Period, the Committee process and ubiquitous media briefings and availabilities.

A longer-term issue for Canadian democracy is that over the past year, power in Ottawa has flowed westward from the Department of Finance, down Wellington Street to the headquarters of the Bank of Canada. Earlier, we posited that the current Bank Governor Tiff Macklem, is the most important person in Ottawa, and thus the most important Canadian. But accountability processes developed in gentler times do not allow Canadians or Parliamentarians to fully peer behind the Bank’s curtains.

In the early months of the crisis, interventions led by former Governor Stephen Poloz and continued by Macklem stabilized markets and ensured liquidity in the banking system. Such intervention did not come cheaply as the balance sheet of the Bank expanded by a multiple of four; purchasing $17 billion in provincial debt, and most importantly more than $350 billion in Government of Canada bonds on the secondary market. Concurrently, settlement balances in the hundreds of billions were deposited with the commercial banks, vastly expanding the money supply. The problem going forward is not just the massive amount of government debt on the balance sheet of the Bank – to which it adds an additional $4 billion a week through its process of Quantitative Easing which will taper over time – but its engagement in policy areas previously the domain of the Department of Finance, and other federal departments.

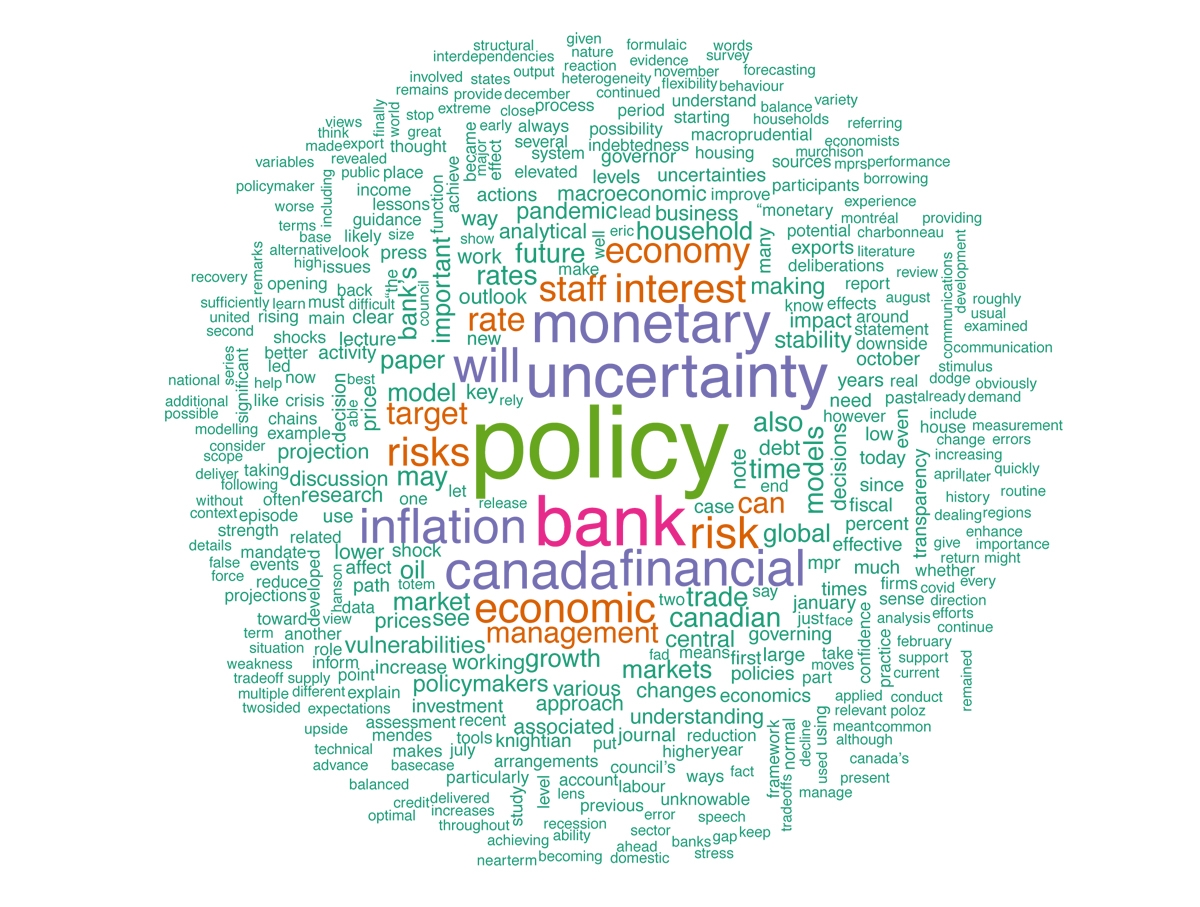

As the word cloud below from April 2020 illustrates, Mr. Poloz focused on the traditional domains of central bankers such as inflation, demand in the economy, financial measures and business confidence. In exercising the Bank’s mandate to conduct monetary policy and promote the stability of the Canadian financial system, Poloz sought to protect the integrity of the Canadian currency, and ensuring liquidity in the commercial banking system. But in transitioning the Bank from a guardian of the currency, and the money supply to become more and more engaged in the specifics of the broader policy debate on the future direction of the economy, Mr. Macklem has vastly expanded the Bank’s repertoire.

For example, in the first week of this month, Macklem prioritized themes such as employment, labour, the ‘scarring’ impact of job loss especially among women and youth, and digitization. The bullseye of the Macklem word cloud focusses like a laser beam on workers, labour and jobs. Attention to this new constellation of issues – labour force scarring, child care and its connection to ameliorating the ‘she-cession’, and accelerating the green transition – is not unwelcome to most Canadians but it is unusual for the Bank, and this mandate creep has occurred in the absence of any public or Parliamentary debate. In the world of central bankers, Macklem has the ‘right stuff’ so this is not a commentary on his considerable talents and ability.

Climate change doesn’t appear in the Bank of Canada Act but Macklem argues that the Bank has a “clear interest in this issue”, in the context of understanding the implications of transitioning to a net-zero economy. Fine. Speaking at a Public Policy Forum webinar last November, he explained that the Bank’s mandate is to manage an ‘efficient and stable financial system that channels savings and capital to the most productive investments, promising sustainable investments’ including those in the green economy. As it turns out, the sector which has welcomed the greatest amount of recent savings and capital investment is not the green economy but the red-hot housing market.

Housing is just one of several difficult files the Bank will have to juggle through this year and into 2022. Despite the Bank’s intent is to hold interest rates low until at least 2023, no one can say with certainty where interest rates are going; the Bank cannot suspend reality. Canadian government bond yields have been rising, and dramatically so just in the past few weeks. As yields rise, the market dictates that interest rates should follow. TD Bank was the first to raise its five-year fixed mortgage rate a couple of weeks ago, and the others have followed.

But as debt levels among all Canadian governments continue to grow, and fiscal stimulus continues to flow into the economy, Macklem will have a more complicated task to control inflation while dampening interest rates. At the same time, despite its independence, the Bank will be under considerable political pressure to keep rates low; both to protect Canadian borrowers but also to avoid ruinous federal payments on a now astronomical debt. Federal stimulus and low rates have Red Bulled the housing sector though, and so-called asset bubbles can be seen in overvalued stocks.

Comments last week from an economist with the Royal Bank of Canada nailed this conundrum for the Bank; the “overheated [housing] market threatens to destabilize the economy down the road if and when a correction occurs, with possible heavy costs for government”. In the interim, millennials and others in Ottawa are increasingly shut out of the housing market, as average prices continue to accelerate, not only year over year, but now month over month. The most the Bank will say is that there is “exuberance” in the market. On behalf of the government, Chrystia Freeland assures Canadians she is watching the situation “very, very closely and carefully.”

The Governor occupies a role independent of the government but the Bank does not function in a vacuum. Despite this central role, our accountability processes have not kept pace, and the Governor’s quarterly appearances before the House of Commons Finance Committee are not adequate, nor are regular speeches at conferences and seminars, Zoomed and Teamed across the nation. The Bank is wrapping up its 5-year review of the Monetary Policy Framework (inflation-control target). While there has been public engagement, enhanced accountability is not an overt objective of the exercise. Mr. Macklem is not nor should he be treated as a politician but his impact and influence on our national discourse is now far beyond that of any of his predecessors. Despite political assurances, Canada is in a perilous fiscal situation, and the Bank is not a neutral bystander. Greater transparency and accountability will engender public confidence and credibility, and ultimately trust. For this reason, we need to consider new avenues and forums of accountability, both to ensure that Canadians understand the new mandate of the Bank, and can be assured that its policy pursuits and actions are not simply to the convenience of the government.

Greg MacDougall is a partner in Government Analytics, an Ottawa firm that specializes in mining, analyzing and formatting government data so that it may be easily communicated for advocacy or corporate purposes. GA utilizes proprietary software to transform raw data into visualized, in-depth evidence. Dan McCarthy writes on a variety of public policy issues.