Wahi Helps Ontarians to Become Homeowners

Anybody who has dipped their toes into the housing market knows that prices have gotten expensive in the last five years. The cost of a home across the county has doubled, even tripled, with the average price in Ottawa now sitting around $ 650,200.

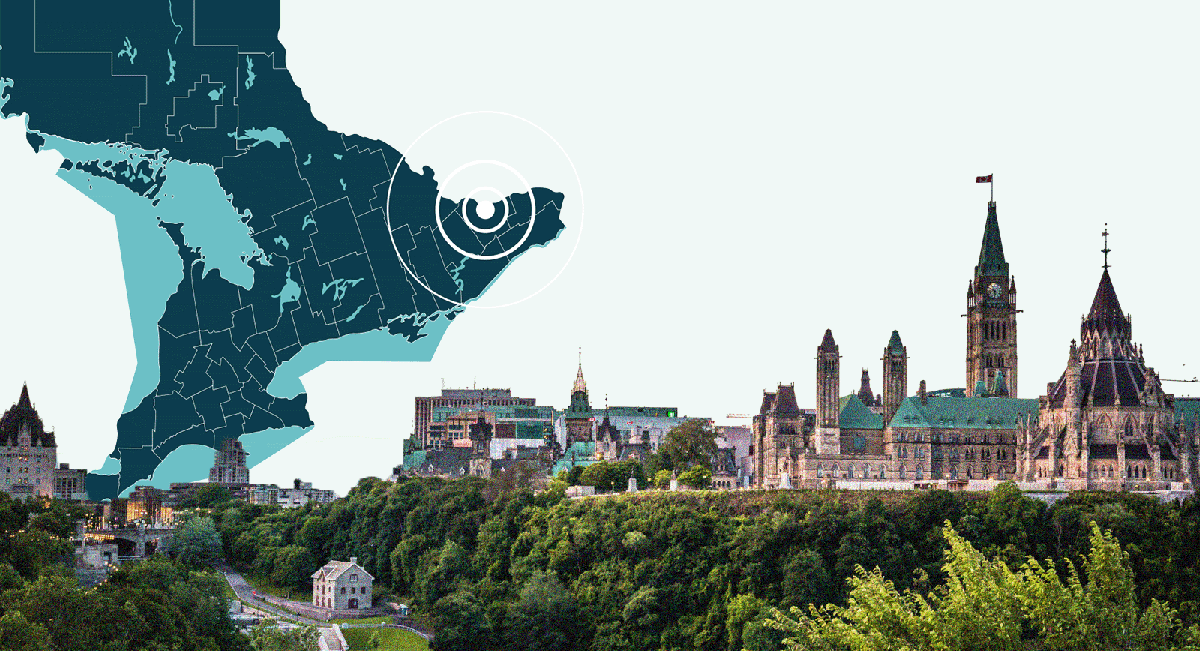

That’s where Wahi comes in; the digital real estate platform has been following housing prices across the province of Ontario and, based on a survey of 245 markets (areas with less than 50 transactions in the first three months of the year were excluded), has created a Digital Roadmap to Housing Affordability.

To use Wahi’s tool, homebuyers enter their income. The tool then provides a map where the median home price is affordable at their income level with a few basic assumptions about how the buyers will pay for the house, including a 20 percent down payment, a mortgage rate of 5.24 percent and a 25-year amortization period.

To meet the affordability threshold, the Wahi calculator assumes that households should spend no more than 25 percent of their monthly income before taxes on mortgage payments.

The average combined income in Ontario, according to Wahi’s study, is approximately $100,000. Unfortunately, the only city in Ontario affordable for those in this income bracket is North Bay, a town of 40,000 inhabitants with a median home price of about $402,000.

The next six most affordable places to purchase a home in Ontario are Owen Sound, with a median home price of $439,000; Greater Sudbury, $470,000; Port Colborne, $499,900; Bells Corners, $499,950; Windsor, $500,000; and Cornwall, $500,000.

The news is bleak for those looking to purchase any time soon in Ottawa, as the homes are currently only affordable in the Bell Corners area. Even then, they are $25,000 above the budget of a standard-income couple.

Other neighbourhoods in the National Capital Region remain unaffordable. Barrhaven, Orleans, the downtown core and even Vanier require a minimum income of $150,000 yearly to own a home or condo. Kanata is worse, with $175,000 a year being the minimum required income to mortgage a house. Given that these areas were considered affordable options before amalgamation, the city’s housing affordability issues will continue. Tack on rising interest rates after eight consecutive hikes by the Bank of Canada.

With all these factors, home ownership is a diminishing prospect for young and new Canadians and anybody who does not make the capital. Despite this, all areas mentioned in Ottawa, including Kanata, fall into the top half of the affordable market for Ontario housing. Still, they remain cheaper than municipalities including Kitchener, Hamilton, and Thunder Bay, all of which are priced similarly to Kanata with its required annual income of $175,000 for home ownership.

There is a silver lining, though. The good news is that Bells Corners is a well-developed area of the city, and a home in the area is still affordable for people like federal public servants, putting a house within reach and an opportunity to build up equity for a move to another part of the city at some point in the future.

Also, if you would like to consider purchasing a house, the interest rate did not go up last month; the Bank of Canada is holding it at 5 percent.

Because of the generally unaffordable housing market, deflation could begin soon; in that case, potential home buyers in Ontario will need to keep an eye on the market.

If you are among those waiting for prices to come down, compare neighbourhoods, towns, and prices to find out what’s best for you. Use the Wahi.com mortgage and financial calculator to determine if you qualify for a mortgage and sign up with them to be alerted when a reasonably priced home pops up on their website.

Are you curious to see which parts of the province are within your homebuying budget? Visit Wahi’s Roadmap to Housing Affordability: Ontario Edition.

For more information, visit wahi.com