America’s Fiscal Albatross

The inaugural celebrations are over and a new Congress has been sworn in. Washington, D.C. is returning to business as usual with the status quo being largely upheld. The White House and the Senate remain in the hands of the Democrats and the House of Representatives in the hands of the Republicans — and the 21st century challenges facing lawmakers remain unaddressed.

Perhaps the most significant of these challenges is finding the way to accelerate America’s anemic economic recovery while shoring up its fiscal house to avoid a decline from world superpower to the world’s best-funded banana republic. Politics in Washington remain polarized. The president’s second inaugural address has been viewed by many liberals as a new manifesto for progressive liberalism in the 21st century. Conversely, conservatives see it as a divisive and combative speech that tenaciously steers America significantly to the left by proposing to rewrite its position on policy issues which would drastically increase the size and scope of government, culminating in a more European America. Not to be overlooked is the fact that there is no guarantee that America’s anticipated economic recovery will occur without addressing its fiscal challenges in a bipartisan manner.

Reality once again deflated presidential rhetoric when the American economy took another unexpected turn for the worse. Recently released data revealed that, in the fourth quarter of 2012, the economy contracted at a rate of 0.1% which, according to the United States Commerce Department, is the worst economic report card received since the onset of the 2008-2009 financial crisis and the first quarterly contraction since the turbulent fall of 2009. To make matters worse, the release of January’s job numbers by the U.S. Labor Department revealed that the American economy created only 157,000 jobs compared to the nearly 200,000 jobs created in December 2012.

While it may be true that the decrease reflected the end of the cyclical (and temporary) holiday retail hiring season, winter storms that curtailed consumer spending, lower levels of inventory investment and the elimination of some 9,000 government jobs, the net result has been an increase in the U.S. unemployment rate from 7.8% to 7.9%. This is bad news for any president embarking upon a second term, especially a president whose second-term agenda (at least according to his inaugural address) appears to focus on the pursuit of contentious “culture war” issues rather than reinvigorating the American economy.

But with more than $16 trillion in debt, continuing high unemployment and the probability that the Obama administration will impose higher tax rates, there is an increasing likelihood that the United States will become less appealing for business investors and entrepreneurs. Furthermore, research projects undertaken by the United States Government Accountability Office (GAO) and the Congressional Budget Office (CBO) — nonpartisan agencies which investigate how the federal government spends taxpayer dollars — have identified that the best-case scenario for the American economy is for it to maintain (not reduce) today’s debt-to-GDP ratio of 72% over the course of the next decade. However, looking beyond 2022, America’s albatross of federal debt will become more unsustainable and a much greater threat because of increased spending on existing entitlement programs — most notably Medicare and Medicaid — due to aging demographics and declining birth rates. Optimistic scenarios have forecast America’s debt-to-GDP ratio at an estimated 160% by mid-century while pessimistic scenarios estimate that figure at 200%. To put this into perspective, Greece’s debt-to-GDP ratio is now closing in on 200%.

While the United States of tomorrow is not necessarily the Greece of today, the objectives outlined by President Obama in his second inaugural address will not reduce the looming fiscal security threat. Clearing a path to legal citizenship for the 11 million illegal immigrants in America, further subsidizing the development of experimental (and unprofitable) alternative energy sources, penalizing the job and wealth-creating traditional energy industries, and limiting the development of the country’s vast shale oil deposits — while advocating higher tax rates for individuals and corporations — will not prevent America’s possible metamorphosis into a bloated reflection of present-day Greece.

The class warfare line of reasoning for increasing tax rates on what the Occupy Wall Street movement has dubbed the “top 1%” of American income earners will not solve America’s economic woes. Under the existing tax code, this so-called “top 1%” already pays more than 40% of all federal income tax and increasing their tax rates substantially — as President Obama has vowed to do — would only make a marginal contribution to paying down America’s debt. Neither punitive tax rates nor subsidized alternative energy projects will remove the fiscal albatross from the neck of the American economy. A realistic discussion followed by an action plan to reduce government entitlement programs and expenditures is what is required. However, the American public will likely remain unaware of this reality should President Obama pursue the priorities set out in his second inaugural address. But then again, this should come as no surprise since, in his first term, President Obama created his own presidential deficit reduction commission — the Simpson-Bowles National Commission on Fiscal Responsibility and Reform — only to ignore its recommendations. Instead, he increased the American deficit by more than $5 trillion in four years and then finished his first term with the American Congress having gone almost a thousand days without passing a budget.

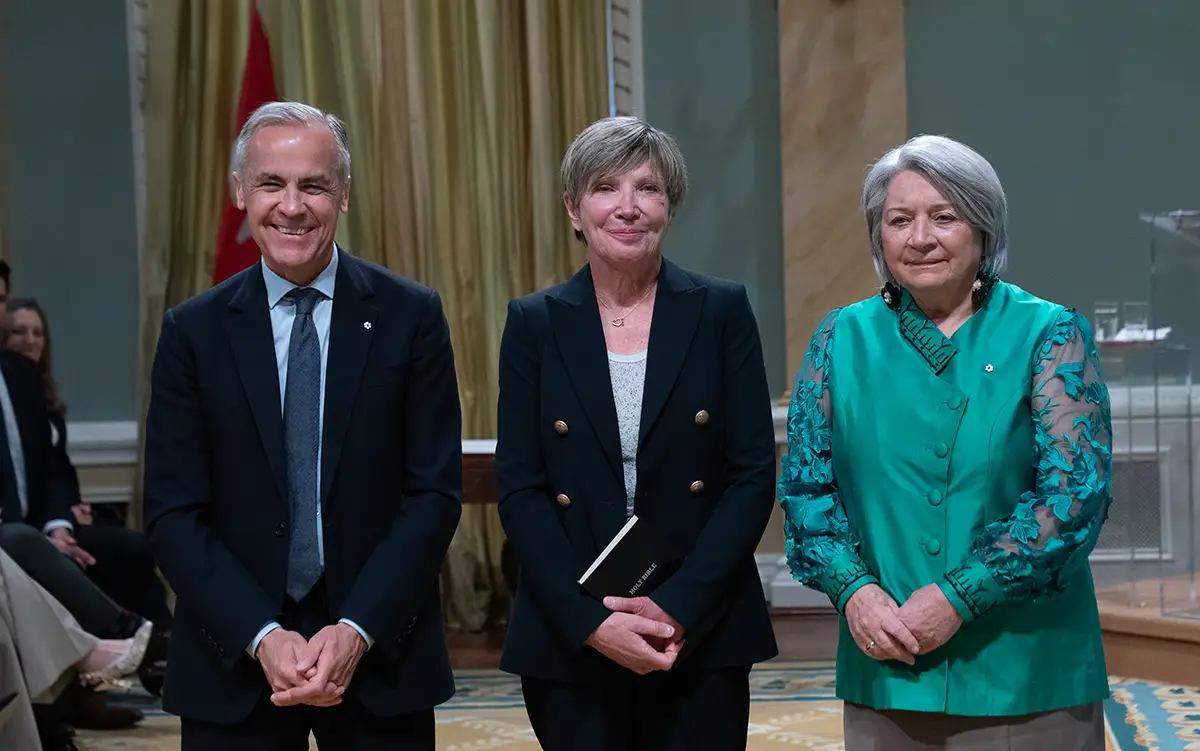

Top Photo: US Magazine